Finance management is an essential aspect of any small business more so in the current world where competition is stiff. It is advisable that for most business people, the eagerness of starting a business is overcome by budgets, cost control and financial planning among others. These circumstances make one comprehend the importance of financial management when one is trying to operate and expand a business in equal measures. Simple and efficient control of costs is useful not only for daily operations, but it also plays a significant role in the organization’s success and sustainability.

Leverage Technology for Efficiency:

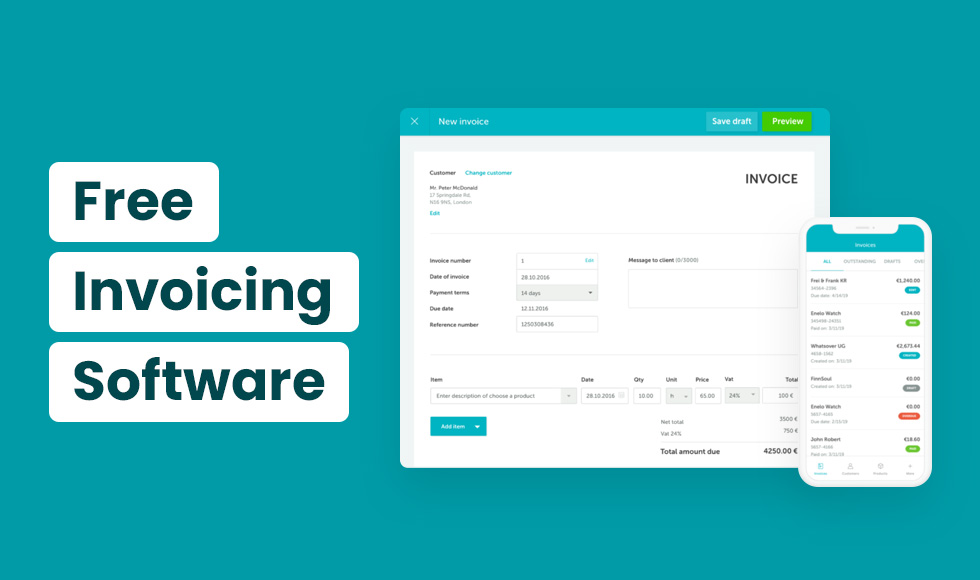

The financial management is a key area that has greatly benefited from the application of technology given that there are solutions and tools that enable efficient management of affairs while at the same time cutting down operational costs. Using free invoicing software can help automate financial tasks such as invoicing and expense tracking without the added cost of premium tools. Once it has been decided that the business needs accounting software, then acquire one that provides functions such as issuance of invoices, tracking of expenses, and preparation of financial reports.

Implement a Comprehensive Budgeting System:

A budget that is well thought out is one that records all the available means of income and groups all the available expenditure. This process begins with the establishment of financial objectives and the determination of line as well as variable expenses. There is rent and salaries which are fixed costs whereas other costs such as promotional materials, stationeries, and electricity can be considered as variable costs. To create an expense plan, it is easy to start with budgeting from the historical records of fiscal movements. This will enable us to predict future expenses and income because it will capture all the necessary information.

Negotiate with Vendors and Suppliers:

It is relatively appropriate to reconsider the options of cutting costs and increasing revenues by adjusting its relations with the vendors and suppliers. Unfortunately, many small business owners miss this chance because they think that prices are in some way unchangeable. However, this may sometimes not be the case, although vendors negotiating on issues related to the length of the tendered contract or bulk buying. It is advisable to start with market research in order to find out industry average for each product or service and potential haggling spots. As you deal with suppliers, be in a position to explain to them your needs as well as your financial capacity.

Monitor and Reduce Utility Costs:

These expenses include the amounts spent on essential services like power supply, water and gas which are main determinants of the overhead costs of a small business. The management of such costs can be effectively addressed if strategies aimed at controlling such costs are put in place hence resulting in huge savings. The first step towards managing energy use is to conduct an audit to determine places that energy wastage is rife. Little changes like changing from traditional bulbs to energy saving bulbs, regulating heating and cooling, and insulating the building will reduce costs greatly.

Optimize Inventory Management:

Another fundamental aspect of controlling business expenses is thus inventory management. Over inventory hampers the capital and the storage costs on the other hand under inventory limit the opportunities to sell products and customer satisfaction. Thus, an ability to achieve a balance is associated with the need for a focus and planning that will remain a constant process. Additionally, consider exploring billing software in pakistan for integrated solutions that combine inventory management with financial tracking, further enhancing efficiency.

The issue of cost saving is very important when it comes to management of finance thus the need small businesses to practice good finance management. A detailed budgeting scheme, the proper management of inventory and supplies, the use of modern technologies, bargaining with the vendors, and tracking the consumption of utilities all enable a small business person to have more control in the expenditures, thus reducing on costs. All these pragmatic approaches also assist in controlling daily outgoings while strongly supporting the overall sustenance and advancement.