- Introduction to Star Health Insurance: Star Health Insurance, a prominent player in the Indian insurance sector, has garnered attention for its commitment to providing comprehensive healthcare coverage. In this exploration, we delve into three key aspects of Star Health Insurance: its share prices, the extensive network of hospitals it collaborates with, and the functionality of its agent portal.

- Understanding Star Health Insurance Share Price: The share price of Star Health Insurance is a dynamic metric influenced by various factors, including market trends, financial performance, and industry dynamics. Investors keen on tracking the financial health of Star Health Insurance can monitor its share prices on stock exchanges. Regular updates, historical data, and analyst insights contribute to informed investment decisions. A rising share price often signifies investor confidence in the company’s growth and stability.

- Key Factors Impacting Share Prices:

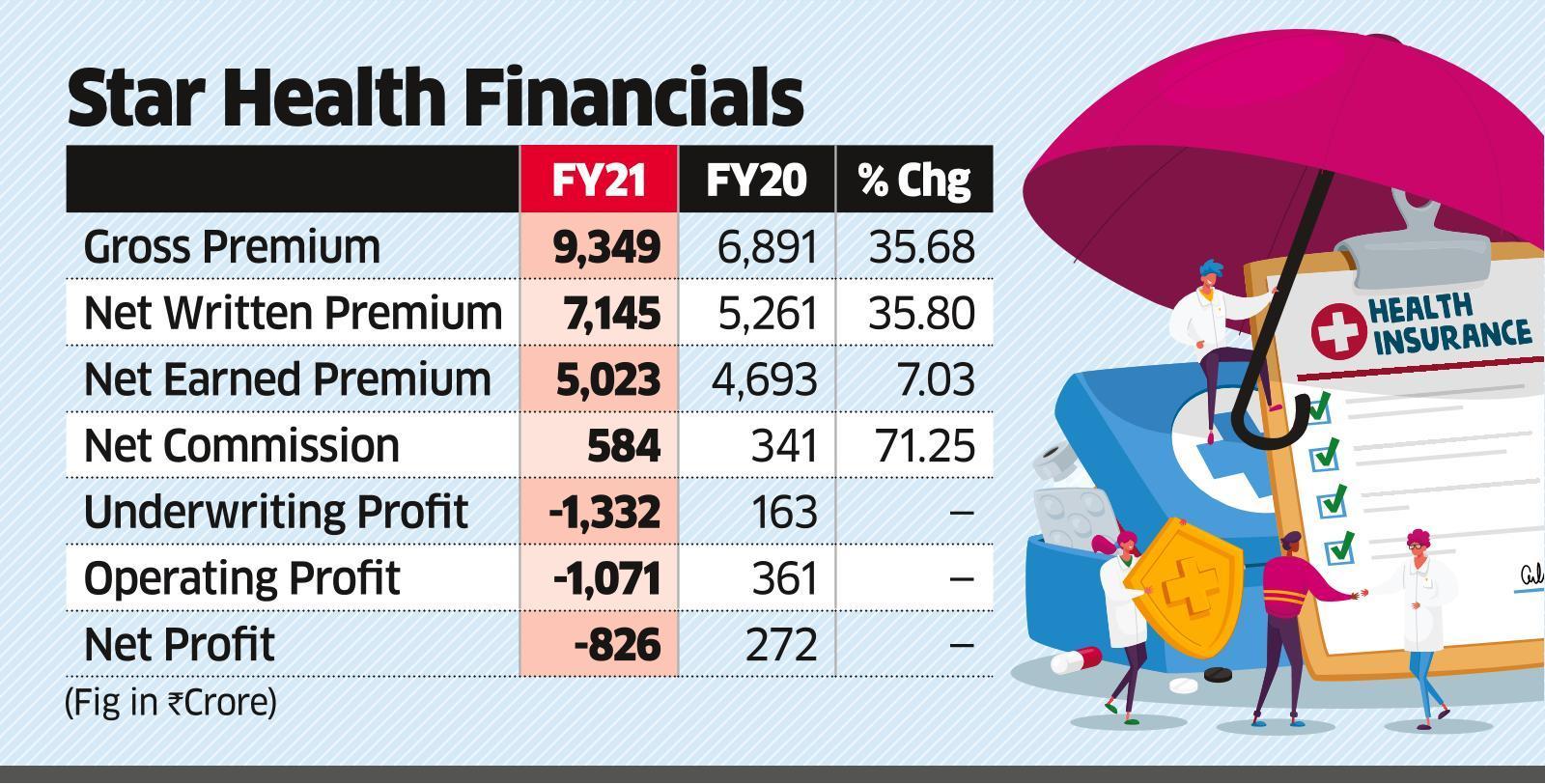

- Financial Performance: Investors analyze Star Health Insurance’s financial reports, including revenue growth, profitability, and solvency ratios, to gauge its overall financial health.

- Market Trends: Macro-economic trends and industry-specific factors, such as regulatory changes or innovations, influence the sentiment surrounding Star Health Insurance and impact its share prices.

- Competitive Positioning: Comparisons with competitors and the company’s market share play a crucial role in determining its perceived value by investors.

- Star Health Insurance Hospital List: A Nationwide Network: Star Health Insurance’s effectiveness in providing quality healthcare coverage is closely tied to its expansive network of hospitals. The insurance provider collaborates with hospitals across India, ensuring that policyholders have access to a wide range of medical facilities. The hospital list, available on the Star Health Insurance website, enables individuals to identify and choose healthcare providers that align with their preferences and requirements.

- Benefits of a Extensive Hospital Network:

- Pan-India Accessibility: Star Health Insurance’s extensive network spans across major cities, towns, and rural areas, facilitating healthcare access for policyholders regardless of their location.

- Cashless Hospitalization: The network hospitals offer the convenience of cashless hospitalization, a significant benefit for policyholders, reducing financial stress during medical emergencies.

- Quality Healthcare Providers: Collaboration with reputed hospitals ensures that policyholders receive quality medical care and have access to a diverse range of specialties.

- Navigating the Star Health Insurance Agent Portal: The agent portal of Star Health Insurance serves as a centralized platform for insurance agents to streamline their operations, manage policies, and provide efficient service to clients. Agents play a pivotal role in the distribution and servicing of insurance products, and the portal enhances their capabilities in several ways.

- Agent Portal Features:

- Policy Management: Agents can efficiently manage policies, including issuance, renewal, and modifications, through the portal, enhancing their ability to provide timely and accurate services to policyholders.

- Customer Interaction: The portal facilitates effective communication between agents and clients, allowing agents to address queries, provide updates, and offer personalized assistance.

- Training and Resources: Agents can access training materials, product information, and resources to stay informed about the latest offerings and industry updates, ensuring they remain well-equipped to serve clients.

- Streamlining Policy Issuance and Renewals: The agent portal streamlines the policy issuance and renewal processes, reducing paperwork and administrative overhead. Agents can seamlessly navigate through the portal to initiate and complete these transactions, enhancing operational efficiency and ensuring a hassle-free experience for clients.

- Enhanced Customer Service: The agent portal plays a crucial role in elevating customer service standards. Agents can promptly address customer queries, provide real-time updates on policy status, and facilitate smoother claim processing through the portal’s intuitive interface.

- Security Measures and Data Confidentiality: Star Health Insurance prioritizes the security of information on the agent portal. Robust encryption and authentication measures ensure that sensitive data related to policies and clients remains confidential. This commitment to data security builds trust among agents and clients alike.

- Continuous Training and Support: To empower agents, Star Health Insurance invests in continuous training programs accessible through the portal. Agents can stay updated on industry trends, product knowledge, and best practices, ensuring they are well-equipped to navigate the ever-evolving landscape of insurance services.

- Future Outlook and Innovations: Star Health Insurance’s commitment to innovation is reflected not only in its hospital network and agent portal but also in its forward-looking initiatives. The company’s future outlook may include technological advancements, new insurance products, and strategic collaborations to further enhance its offerings and maintain a competitive edge in the industry.

Conclusion

In conclusion, Star Health Insurance stands as a key player in the Indian insurance sector, offering comprehensive healthcare coverage. The dynamism of its share prices reflects investor confidence, with factors like financial performance, market trends, and competitive positioning influencing its valuation. The extensive nationwide network of hospitals ensures policyholders have access to quality healthcare facilities, supported by the convenience of cashless hospitalization.

The agent portal plays a pivotal role in the company’s operations, empowering insurance agents to efficiently manage policies, enhance customer interactions, and stay updated on industry trends. The portal’s features contribute to streamlined policy issuance, renewal processes, and elevated customer service standards, all while prioritizing data security and confidentiality.

Looking ahead, Star Health Insurance’s commitment to innovation suggests a future that may include technological advancements, new insurance products, and strategic collaborations, further solidifying its position in the evolving landscape of healthcare coverage.

FAQ

1. How can investors track Star Health Insurance’s financial health?

Investors can monitor Star Health Insurance’s financial health by tracking its share prices on stock exchanges, analyzing financial reports, and staying informed about market trends and competitive positioning.

2. What are the benefits of Star Health Insurance’s extensive hospital network?

The extensive hospital network provides pan-India accessibility, offers the convenience of cashless hospitalization, and ensures policyholders have access to quality healthcare providers across various specialties.

3. What features does the Star Health Insurance agent portal offer?

The agent portal facilitates policy management, customer interaction, training, and resources for insurance agents. It streamlines policy issuance, renewals, and enhances customer service standards.

4. How does the agent portal contribute to data security?

The agent portal prioritizes data security through robust encryption and authentication measures, ensuring the confidentiality of sensitive information related to policies and clients.

5. What can we expect in the future from Star Health Insurance?

Star Health Insurance’s future outlook may include technological advancements, new insurance products, and strategic collaborations to enhance its offerings and maintain a competitive edge in the industry.